Income Annuities

Income annuities convert your retirement savings into guaranteed lifetime income starting immediately or in the future

What Is an Income Annuity?

An income annuity is a lifetime income guarantee that you purchase from an insurance company as a way to reduce the risk that you run out of money in retirement. Just like you insure your home, you can insure your longevity by passing on the risk that you outlive your savings to an insurance company.

There are many ways to fund an income annuity — years before retirement, at retirement, over time, etc. — but they all provide you with the same thing: a guaranteed, steady lifetime-income stream when you retire that simplifies your retirement spending and offers peace of mind that you will not outlive your savings. You can think of it like a pension you buy for yourself.

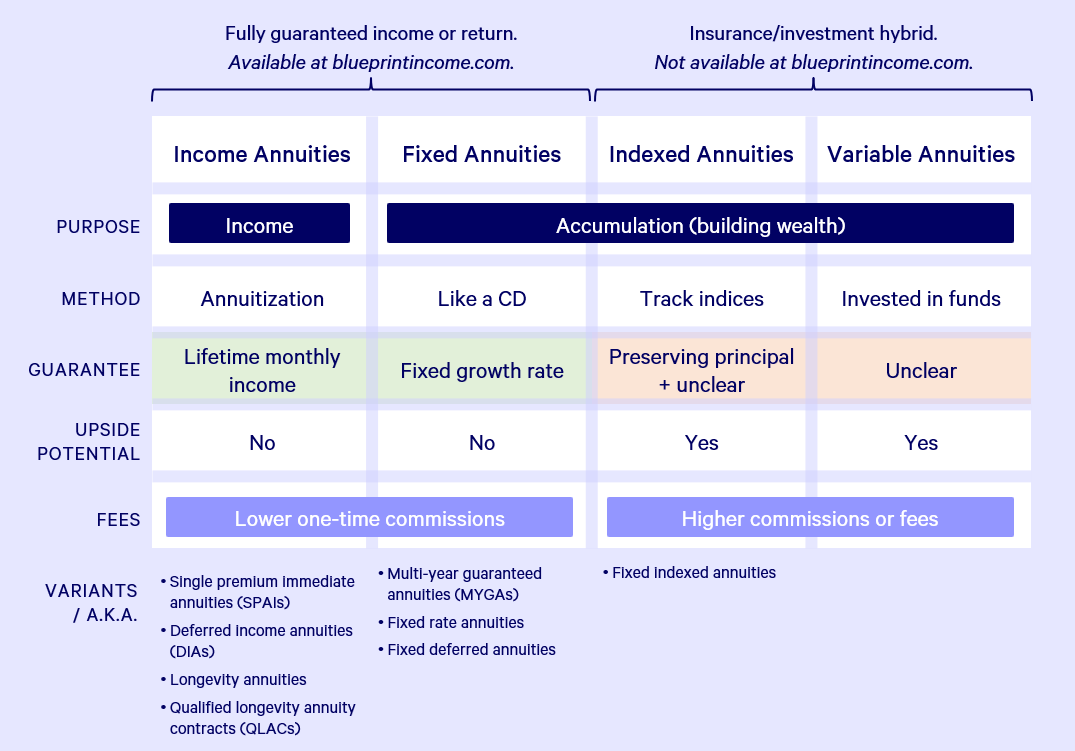

All annuities are built on this core concept; however, annuities can be complicated by various features, bells, and whistles that make them harder to understand, challenging to evaluate, and, in our opinion, less valuable. At Blueprint Income, we provide only income annuities (immediate annuities, longevity annuities, and Qualified Longevity Annuity Contracts) and fixed annuities. These are the simplest of products, offering either guaranteed income (income annuity) or guaranteed return (fixed annuity). They are explicit in what you’ll get in exchange for the money you put in, and they’re the cheapest way to get a guarantee.

Here are the various types of annuities out there:

Is an Income Annuity Right for You?

An income annuity may be right for you if:

- Your Social Security and/or pension benefits are not enough to cover your regular expenses,

- You have already started saving for retirement,

- You are in above-average health and hope to live a long life, or

- You are seeking greater certainty in retirement.

Annuities, are not, however, designed to be the totality of your retirement nest egg, as they don’t provide everything you need in retirement. In particular, they do not have the potential to provide high stock market returns, and they are typically not indexed for inflation.

For anyone interested in minimizing the risk of running out of money while maximizing the legacy you leave behind, the portfolio strategy that predicts the best outcomes are those with annuities instead of bonds. Read more about our research about retirement portfolio optimization here.

Types of Income Annuities

There are three types of income annuities. All provide a steady, guaranteed paycheck for life, but they differ in when that income starts and the money used to fund them. The three types of income annuities are:

- Immediate Annuities: For those about to retire or already retired, immediate annuities provide income starting within 12 months.

- Longevity Annuities: For those farther from retirement, longevity annuities provide income starting more than 1 year from now.

- Qualified Longevity Annuity Contracts (QLACs): For those looking to defer IRA required minimum distributions, QLACs are longevity annuities purchased with Traditional IRA savings with income starting after age 73 but before 85.

Quotes for all 3 types of income annuities are available for free on our website via the Income Annuity Quote Tool. Read on for more information, financial examples, and details about each of the types of income annuities.

Type | Immediate Annuity | Longevity Annuity | QLAC |

Starts | Within 1 year | In more than 1 year | In more than 1 year, after age 73, and by age 85 |

Provides | Guaranteed income for the rest of your life | Guaranteed income for the rest of your life | Guaranteed income for the rest of your life |

Funded With | Qualified (IRA) or non-qualified (personal savings) money | Qualified (IRA) or non-qualified (personal savings) money | Only qualified money (Traditional IRA or 401(k) rollover) |

Immediate Annuities

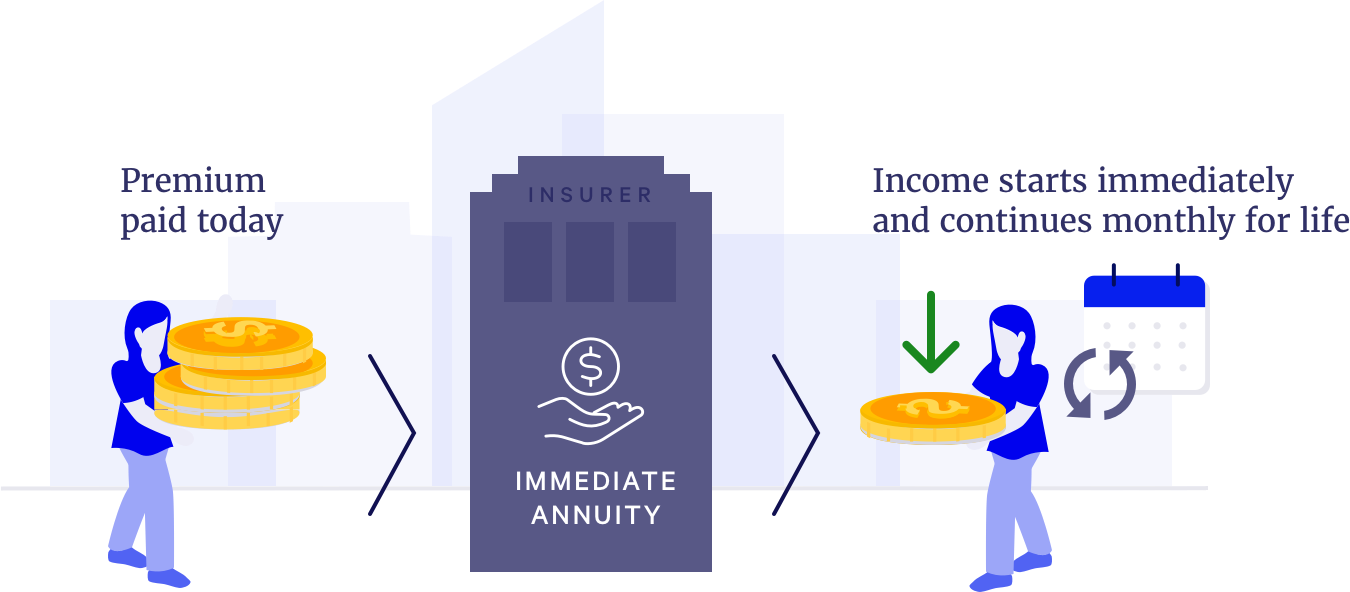

An immediate annuity is an income annuity that starts within 12 months. It is funded by giving a lump-sum premium deposit to an insurance company, and in exchange, the insurer promises steady, guaranteed income that continues for the rest of your life. You can think of it like a pension you buy for yourself.

Tip: You might hear this product referred to using a few different names:

- Single premium immediate annuity

- Immediate annuity

- SPIA

When you’re ready, you can get personalized quotes for free in the Immediate Annuity Quote Tool.

Longevity Annuities

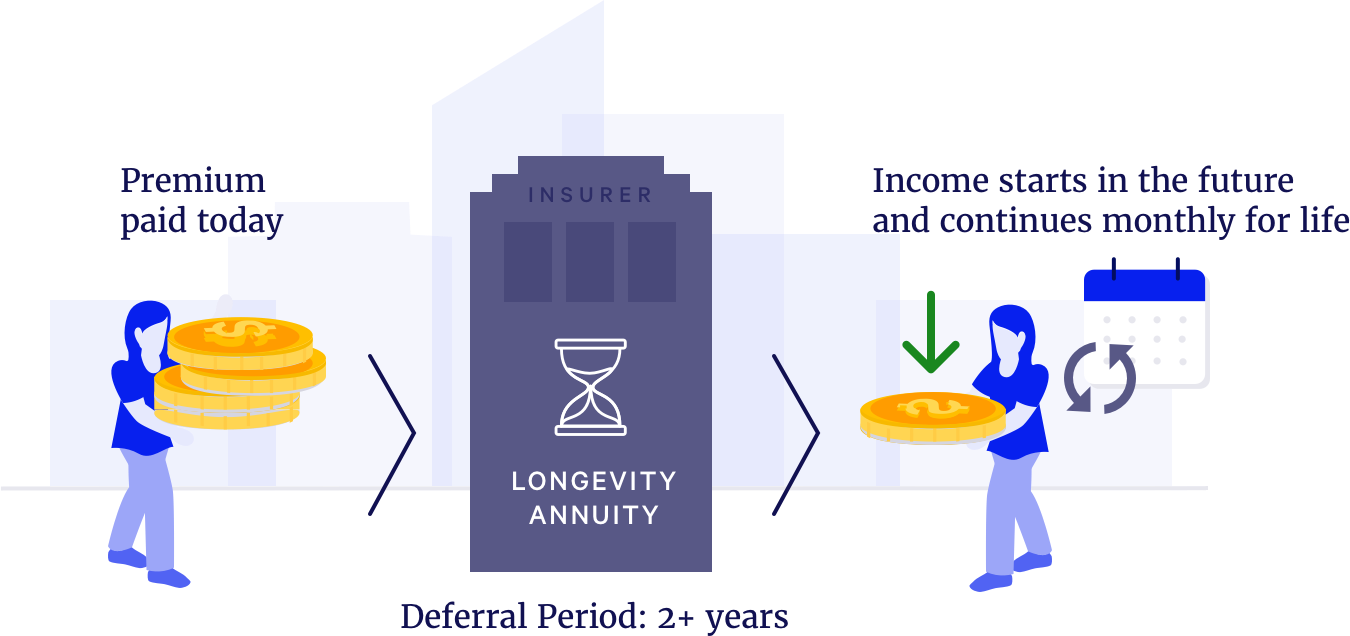

A longevity annuity is an income annuity that starts more than 12 months from now. It is funded through a lump-sum premium or recurring deposits over time. In exchange, the insurance company promises steady, guaranteed income that continues for the rest of your life. You can think of it like a pension you buy for yourself.

Tip: You might hear this product referred to using a few different names:

- Longevity annuity

- Deferred income annuity

- DIA

Head over to the longevity annuity guide to learn more about these products, see examples of them in action, and get buying tips. When you’re ready, you can get personalized quotes for free in the Longevity Annuity Quote Tool.

Qualified Longevity Annuity Contracts

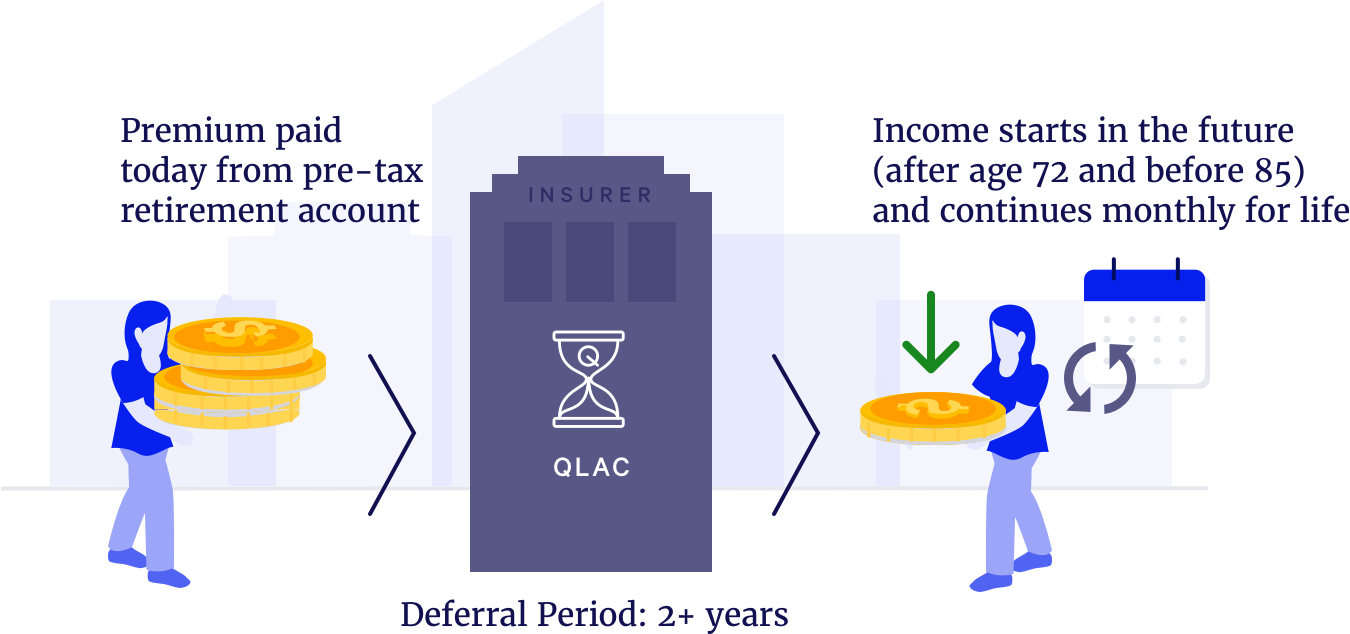

A Qualified Longevity Annuity Contract, or QLAC for short, is a special type of longevity purchased with tax-deferred savings from your qualified retirement account, such as a Traditional IRA. It provides income starting more than 1 year from now, starting after age 73 but by age 85. It’s the only way to defer required minimum distributions (RMDs) applicable to 401(k)s and Traditional IRAs beyond the age of 73.

Head over to the QLAC guide to learn more about these products, see examples of them in action, and get buying tips. When you’re ready, you can get personalized quotes for free in the QLAC Quote Tool.

Buying an Income Annuity Online

It’s now possible to make your income annuity purchase online. Instead of in-person meetings and paper applications, we’ve built the technology to provide you real-time quotes online and generate your application for the insurer digitally. We’re licensed to provide these products to you, and we’re available via chat, email, or phone to provide personalized assistance.

Here is the process to secure your income annuity online:

- Run quotes using the free Income Annuity Quote Tool.

- Review the details of the annuities and your quotes.

- If you’re not ready to buy, you can lock in your quote for 7-14 days with the “Lock Quote” feature. Keep in mind that in order to get these locked rates, a completed application needs to be accepted by the insurer before quote expiration.

- Once you’re ready, click “Apply” on any new quote or locked quotes in your account.

- Fill out the online application in under 10 minutes.

- Our team will follow up to confirm your purchase and submit the application to the insurer(s) on your behalf.

If you have any questions, don’t hesitate to reach out to our team.